原创内容第811篇,专注量化投资、个人成长与财富自由。今天再发布一个“会员专属”的策略,是个人比较喜欢的。

@calc_by_symbol

def trend_score(close, period=25):

"""

向量化计算趋势评分:年化收益率 × R平方

:param close: 收盘价序列(np.array或pd.Series)

:param period: 计算窗口长度,默认25天

:return: 趋势评分数组,长度与输入相同,前period-1位为NaN

"""

if len(close) < period:

return np.full_like(close, np.nan)

y = np.log(close)

windows = np.lib.stride_tricks.sliding_window_view(y, window_shape=period)

x = np.arange(period)

# 预计算固定值

n = period

sum_x = x.sum()

sum_x2 = (x ** 2).sum()

denominator = n * sum_x2 - sum_x ** 2

# 滑动窗口统计量

sum_y = windows.sum(axis=1)

sum_xy = (windows * x).sum(

axis=1)

# 回归系数

slope = (n * sum_xy - sum_x * sum_y) / denominator

intercept = (sum_y - slope * sum_x) / n

# 年化收益率

annualized_returns = np.exp(slope * 250) - 1

# R平方计算

y_pred = slope[:, None] * x + intercept[:, None]

residuals = windows - y_pred

ss_res = np.sum(residuals ** 2, axis=1)

sum_y2 = np.sum(windows ** 2, axis=1)

ss_tot = sum_y2 - (sum_y ** 2) / n

r_squared = 1 - (ss_res / ss_tot)

r_squared = np.nan_to_num(r_squared, nan=0.0) # 处理零方差情况

# 综合评分

score = annualized_returns * r_squared

# 对齐原始序列长度

full_score = np.full_like(y, np.nan)

full_score = pd.Series(index=close.index)

full_score[period - 1:] = score

return full_score

from bt_algos_extend import Task, Engine

def ranking_ETFs():

t = Task()

t.name = '基于ETF历史评分的轮动策略'

# 排序

t.period = 'RunDaily'

t.weight = 'WeighEqually'

t.order_by_signal = 'trend_score(close,25)'

t.start_date = '20180101'

#t.end_date = '20240501'

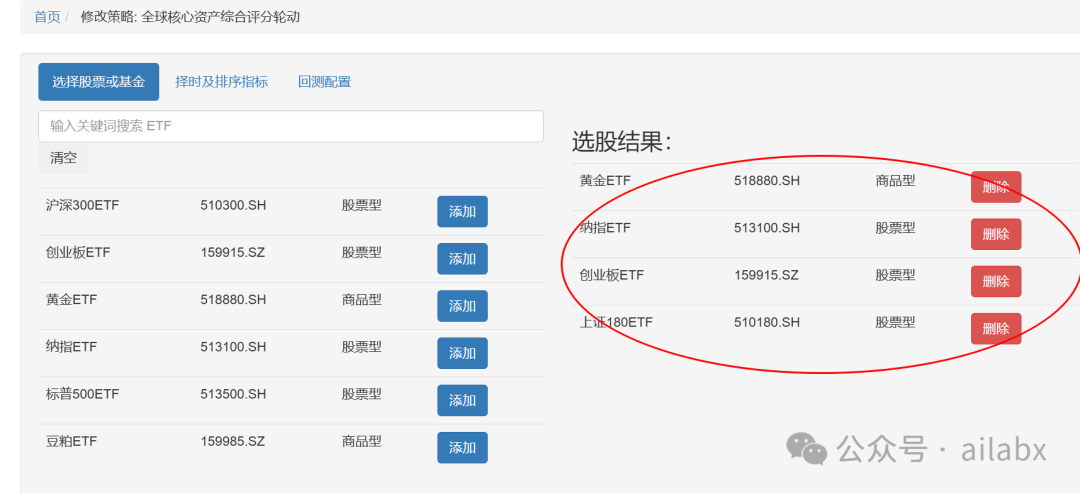

t.symbols = [

'518880.SH', # 黄金ETF(大宗商品)

'513100.SH', # 纳指100(海外资产)

'159915.SZ', # 创业板100(成长股,科技股,中小盘)

'510180.SH', # 上证180(价值股,蓝筹股,中大盘)

]

t.benchmark = '510300.SH'

return t

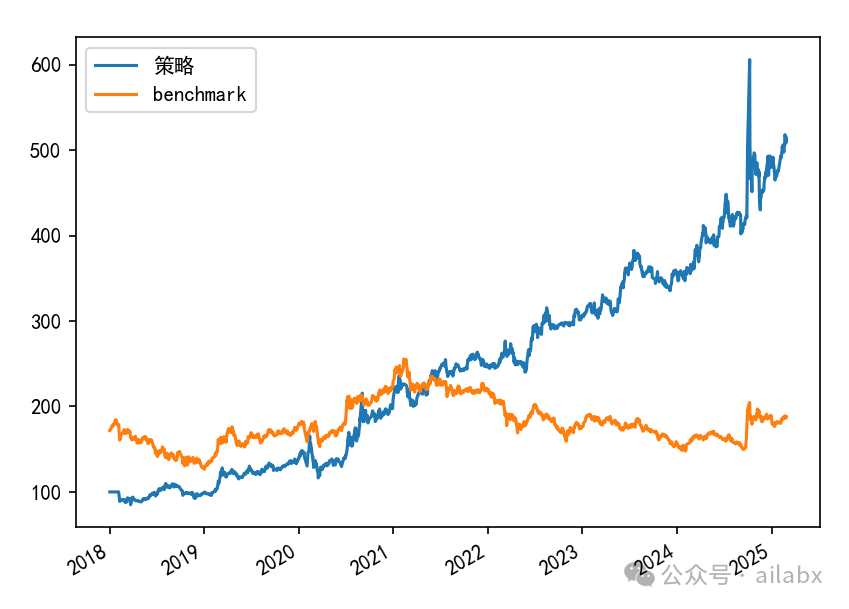

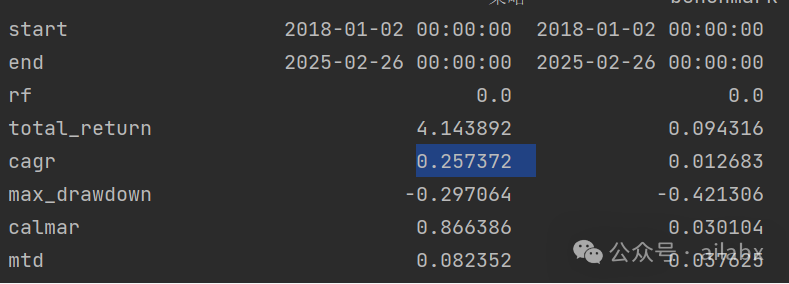

res = Engine().run(ranking_ETFs())

import matplotlib.pyplot as plt

print(res.stats)

from matplotlib import rcParams

rcParams['font.family'] = 'SimHei'

#res.plot_weights()

res.prices.plot()

plt.show()

AI量化实验室 星球,已经运行三年多,1500+会员。

aitrader代码,因子表达式引擎、遗传算法(Deap)因子挖掘引擎等,支持vnpy,qlib,backtrader和bt引擎,内置多个年化30%+的策略,每周五迭代一次,代码和数据在星球全部开源。