原创内容第970篇,专注AGI+,AI量化投资、个人成长与财富自由。从量化指标的角度,有趋势指标和震荡指标,通过历史的价量数据去描述价格运动的状态。——部分有统计学的逻辑基础。咱们在使用一个或多个指标时,一定要了解指标背后的计算公式,最好自己上手计算一下,这样就会理解这个指标的应用,适用场景及局限性。今天咱们来说说aroon指标,并基于这个指标做一些回测。aroon指标(又称阿隆指标)是由技术分析大师图莎尔·钱德(Tushar Chande)于1995年提出的趋势跟踪类指标。其名称源于梵文“Aroon”,意为“黎明之光”,寓意其能早期探测趋势的萌芽。相较于MACD、RSI等传统指标,Aroon因使用者较少且侧重“时间维度”而非价格波动,被认为在趋势识别上更具独特性和稳定性。Aroon Up(上升线)

= [(N - 距离最近最高价的天数) / N] × 100

衡量当前价格与近期最高价的“时间距离”,数值越高说明上升趋势越强18。

Aroon Down(下降线)

= [(N - 距离最近最低价的天数) / N] × 100

衡量当前价格与近期最低价的“时间距离”,数值越高说明下降趋势越强49。

Aroon Oscillator(震荡线)

= Aroon Up - Aroon Down

用于量化多空力量差值,正值表示上升主导,负值表示下降主导。

开仓信号:

该策略使用两种主要的开仓信号:

- 多头信号:Aroon Up从下方穿越Aroon Down

- 空头信号:Aroon Down从下方穿越Aroon Up

平仓信号:

平仓信号基于Aroon指标的反向交叉:

- 平多信号:Aroon Down从下方穿越Aroon Up

- 平空信号:Aroon Up从下方穿越Aroon Down

这些反向信号往往代表趋势可能发生转变,是获利了结的好时机。

止损机制:

该策略使用基于百分比的固定止损:

- 止损百分比设定为1.2%(STOP_LOSS_PCT = 1.2)

from tqsdk import TqApi, TqAuth, TqBacktest, TargetPosTask, BacktestFinishedimport pandas as pdfrom datetime import date

from tqsdk import TqApi, TqAuth,TqBacktest,TargetPosTaskimport pandas as pdfrom datetime import dateimport osdef get_env_var(name, default=None): value = os.environ.get(name) if value is None and default is None: raise EnvironmentError(f"环境变量 {name} 未设置")

return value or defaultusername = get_env_var('TQ_USERNAME')password = get_env_var('TQ_PASSWORD')

SYMBOL = "SHFE.au2306" POSITION_SIZE = 30 START_DATE = date(2023, 2, 20) END_DATE = date(2023, 5, 5)

AROON_PERIOD = 10 AROON_UPPER_THRESHOLD = 75 AROON_LOWER_THRESHOLD = 25

STOP_LOSS_PCT = 1.2

position = 0 entry_price = 0 trades = []

print(f"开始回测 {SYMBOL} 的Aroon指标策略...")print(f"参数: Aroon周期={AROON_PERIOD}, 上阈值={AROON_UPPER_THRESHOLD}, 下阈值={AROON_LOWER_THRESHOLD}")print(f"回测期间: {START_DATE} 至 {END_DATE}")

try: api = TqApi(backtest=TqBacktest(start_dt=START_DATE, end_dt=END_DATE), auth=TqAuth(username, password))

klines = api.get_kline_serial(SYMBOL, 60 * 60 * 24) target_pos = TargetPosTask(api, SYMBOL)

while True: api.wait_update()

if api.is_changing(klines.iloc[-1], "datetime"): if len(klines) < AROON_PERIOD + 10: continue

klines['rolling_high'] = klines['high'].rolling(window=AROON_PERIOD).max() klines['rolling_low'] = klines['low'].rolling(window=AROON_PERIOD).min()

aroon_up = [] aroon_down = []

for i in range(len(klines)): if i < AROON_PERIOD - 1: aroon_up.append(0) aroon_down.append(0) continue

period_data = klines.iloc[i - AROON_PERIOD + 1:i + 1] high_idx = period_data['high'].fillna(float('-inf')).argmax() low_idx = period_data['low'].fillna(float('inf')).argmin()

days_since_high = i - (i - AROON_PERIOD + 1 + high_idx) days_since_low = i - (i - AROON_PERIOD + 1 + low_idx)

aroon_up.append(((AROON_PERIOD - days_since_high) / AROON_PERIOD) * 100) aroon_down.append(((AROON_PERIOD - days_since_low) / AROON_PERIOD) * 100)

klines['aroon_up'] = aroon_up klines['aroon_down'] = aroon_down

klines['aroon_osc'] = klines[

'aroon_up'] - klines['aroon_down']

current_price = float(klines.close.iloc[-1]) current_time = pd.to_datetime(klines.datetime.iloc[-1], unit='ns') current_aroon_up = float(klines.aroon_up.iloc[-1]) current_aroon_down = float(klines.aroon_down.iloc[-1])

prev_aroon_up = float(klines.aroon_up.iloc[-2]) prev_aroon_down = float(klines.aroon_down.iloc[-2])

print(f"当前K线: {current_time.strftime('%Y-%m-%d')}, 价格: {current_price:.2f}") print(f"Aroon Up: {current_aroon_up:.2f}, Aroon Down: {current_aroon_down:.2f}")

if position != 0 and entry_price != 0: if position > 0: profit_pct = (current_price / entry_price - 1) * 100 if profit_pct < -STOP_LOSS_PCT: print(f"触发止损: 当前价格={current_price}, 入场价={entry_price}, 亏损={profit_pct:.2f}%") target_pos.set_target_volume(0) trades.append({ 'type': '止损平多', 'time': current_time, 'price': current_price, 'profit_pct': profit_pct }) print(f"止损平多: {current_time}, 价格: {current_price:.2f}, 亏损: {profit_pct:.2f}%") position = 0 entry_price = 0 continue

elif position 0: profit_pct = (entry_price / current_price - 1) * 100 if profit_pct < -STOP_LOSS_PCT: print(f"触发止损: 当前价格={current_price}, 入场价={entry_price}, 亏损={profit_pct:.2f}%") target_pos.set_target_volume(0) trades.append({ 'type': '止损平空', 'time': current_time, 'price': current_price, 'profit_pct': profit_pct }) print(f"止损平空: {current_time}, 价格: {current_price:.2f}, 亏损:

{profit_pct:.2f}%") position = 0 entry_price = 0 continue

aroon_cross_up = prev_aroon_up < prev_aroon_down and current_aroon_up > current_aroon_down aroon_cross_down = prev_aroon_up > prev_aroon_down and current_aroon_up < current_aroon_down

strong_up = current_aroon_up > AROON_UPPER_THRESHOLD and current_aroon_down < AROON_LOWER_THRESHOLD strong_down = current_aroon_down > AROON_UPPER_THRESHOLD and current_aroon_up < AROON_LOWER_THRESHOLD

if position == 0: if aroon_cross_up or strong_up: position = POSITION_SIZE entry_price = current_price target_pos.set_target_volume(position) signal_type = "交叉" if aroon_cross_up else "强势" trades.append({ 'type': '开多', 'time': current_time, 'price': current_price, 'signal': signal_type }) print(f"开多仓: {current_time}, 价格: {current_price:.2f}, 信号: Aroon {signal_type}")

elif aroon_cross_down or strong_down: position = -POSITION_SIZE entry_price = current_price target_pos.set_target_volume(position) signal_type = "交叉" if aroon_cross_down else "强势" trades.append({ 'type': '开空', 'time': current_time, 'price': current_price, 'signal': signal_type }) print(f"开空仓: {current_time}, 价格: {current_price:.2f}, 信号: Aroon {signal_type}")

elif position > 0: if aroon_cross_down: profit_pct = (current_price / entry_price - 1) * 100 target_pos.set_target_volume(0) trades.append({ 'type': '平多', 'time': current_time, 'price': current_price, 'profit_pct': profit_pct }) print(f"平多仓: {current_time}, 价格: {current_price:.2f}, 盈亏: {profit_pct:.2f}%") position = 0 entry_price = 0

elif position 0: if aroon_cross_up: profit_pct = (entry_price / current_price - 1) * 100 target_pos.set_target_volume(0)

trades.append({ 'type': '平空', 'time': current_time, 'price': current_price, 'profit_pct': profit_pct }) print(f"平空仓: {current_time}, 价格: {current_price:.2f}, 盈亏: {profit_pct:.2f}%") position = 0 entry_price = 0

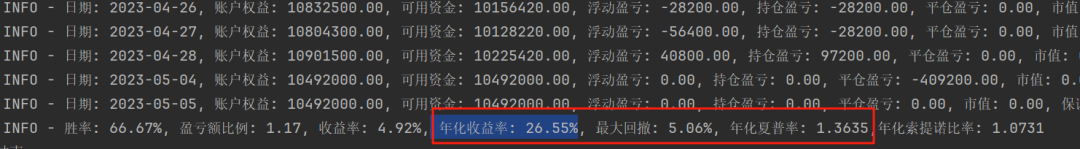

except BacktestFinished as e: print("回测结束") api.close()

代码和数据下载:AI量化实验室——2025量化投资的星辰大海AI量化实验室 星球,已经运行三年多,1700+会员。

aitrader代码,因子表达式引擎、遗传算法(Deap)因子挖掘引擎等,支持vnpy,qlib,backtrader和bt引擎,内置多个年化30%+的策略,每周五迭代一次,代码和数据在星球全部开源。

点击 “查看原文”,直接访问策略集合。